Budgeting is an essential part of managing personal finances. It can help you make the most out of your income, and make sure you have enough funds to meet your needs. There are several methods of budgeting, and one of the most popular is the 50/30/20 Rule.

What Is the 50/30/20 Rule?

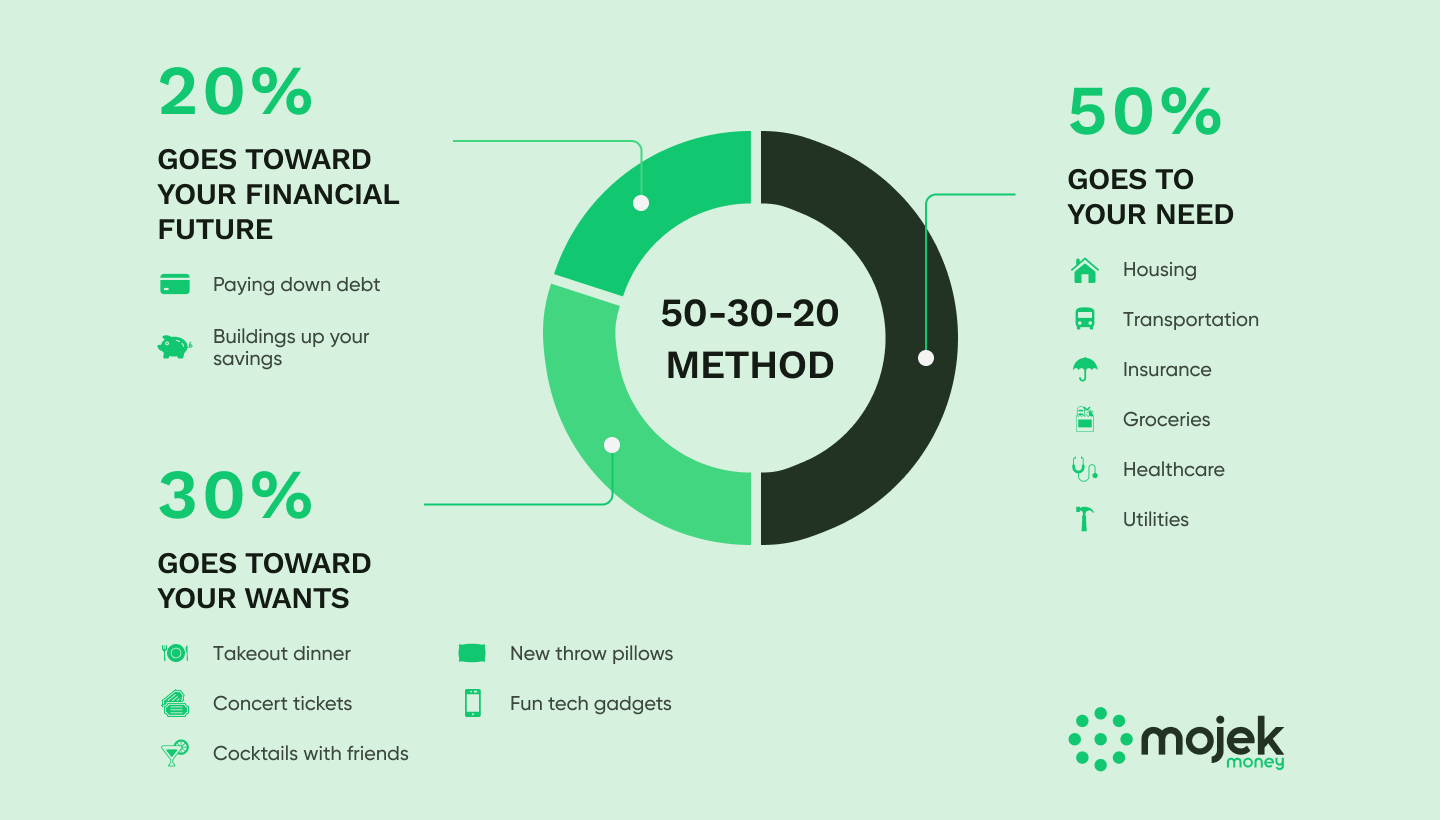

This rule is a budgeting approach that divides your income into three categories — 50%, 30% and 20%. The first 50% is assigned to essential expenses such as rent, food, and utilities. This portion should be allocated only for essential costs, and not for travel, entertainment or shopping. The next 30% is allocated to wants such as travel, shopping, or entertainment. This part of the budget is meant to be used on discretionary items, not necessary expenses. The final 20% is saved for financial priorities such as debt repayment, retirement savings and emergency funds. The goal of the 50/30/20 Rule is to evenly divide your income between essential, preferred and savings expenses.

50/30/20 Rule is also a great way to ensure that you are responsibly saving for the future. It is important to remember that the 50/30/20 Rule is a guideline, not a hard and fast rule. You may need to adjust the percentages depending on your individual financial situation. For example, if you have a large amount of debt, you may need to allocate more of your income to debt repayment and less to discretionary spending. Additionally, if you have a large amount of savings, you may be able to allocate more of your income to discretionary spending.

It is also important to remember that budgeting is a process and it may take some time to get used to. Start by tracking how much you spend for a few months to get an idea of where your money is going and once you have a better understanding of how much you spend, you can begin to adjust your budget accordingly. With a little bit of effort and dedication, you can use the 50/30/20 Rule to create an ultimate lifetime money plan.

Benefits of Budgeting Using the 50/30/20 Rule

50/30/20 has several benefits that can help you better manage your money:

- It’s easy to follow because it doesn’t involve complex calculations.

- It helps you avoid unnecessary spending and stay in control of your finances.

- It encourages both disciplined and indulgent spending, which helps you maintain a healthy balance between the two.

This approach also helps you prioritize your spending and savings goals. You can easily identify which expenses are essential and which ones are not, and allocate your money accordingly. Additionally, it can help you save for long-term goals, such as retirement, while still allowing you to enjoy life in the present.

How to Set Up a 50/30/20 Budget

Setting up a 50/30/20 budget is relatively easy. Here are the steps you need to take:

- Calculate your total monthly income.

- Determine which expenses are essential, and which are discretionary.

- Divide your income into three spending categories:

– 50% essential, 30% wants and 20% savings. - Deduct your essential expenses from the 50% section of your budget.

- Subtract discretionary expenses from the 30% section of your budget.

- Put anything left over from both sections into savings.

Once you have set up your 50/30/20 budget, it is important to track how much you spend and make sure you are staying within your budget. You can use a budgeting app or spreadsheet to help you stay on track. Additionally, it is important to review your budget periodically to make sure it is still working for you and that your spend and saving goals are still realistic.

Tips for Making 50/30/20 Rule Work for You

Making 50/30/20 Rule work doesn’t have to be complicated. Here are some tips:

- Break down your budget into smaller amounts. This can make it easier to manage and track expenses.

- Keep track of your spends by monitoring each transaction closely. Monitor your bank account, credit cards and debit cards closely.

- Be aware of what you’re spending on with each transaction. This will help you stay within your budget.

- Be realistic when creating a budget. If a 50/30/20 budget isn’t feasible for your situation, adjust the percentages accordingly.

What to include in Essentials (50%) – These go towards your needs

- Housing/Rent utilities

- Transportation

- Insurance

- Groceries

- Healthcare

- Utilities

What to include in Wants (30%)

- Takeout dinners

- Entertainment (Concerts, movies etc)

- Dinner and drinks with friends

- Fun tech gadgets

What to include in Savings (20%) – These go towards your future savings

- Build your future savings

- Paying debt payments (Credit Cards bills, loans etc)

It’s important to remember that budgeting is a process and it takes time to get used to. Don’t be discouraged if you don’t get it right the first time. Take the time to review your budget and make adjustments as needed.

It’s also important to remember that budgeting is not a one-time event. You should review your budget regularly and make adjustments as needed. This will help you stay on track and ensure that you are meeting your financial goals.

How to Make Adjustments to Your 50/30/20 Budget

JJust because you set up a 50/30/20 budget doesn’t mean it won’t need to be adjusted over time. When your income changes or you have unexpected expenses due to unforeseen circumstances, it’s important to review how you are using your money and make adjustments accordingly. This can be done by reallocating your spends in two ways:

- For unexpected expenses, review the 20% section of your budget first to determine if there are funds available. If not, examine ways to reduce spends in one or more of the other sections in order to meet the new expense.

- When income changes, it’s important to review the amount devoted to each section in order to ensure that you are still managing your money efficiently. Consider changing the percentages slightly depending on your needs while still following the basic framework of 50/30/20 Rule.

It’s important to remember that budgeting is a fluid process. As your life changes, so should your budget. If you find yourself in a situation where you need to make adjustments to your 50/30/20 budget, it’s important to take a step back and assess your current financial situation. Consider your income, all your expenses, and goals, and then make adjustments accordingly.

When making adjustments to your budget, it’s important to be realistic. Don’t try to cut too much from one area or add too much to another. Make small, incremental changes that you can stick to. This will help you stay on track and reach your financial goals.

Tracking Your Progress with a 50/30/20 Budget

It’s important to track your progress when using a 50/30/20 budget. This will help you stay on track and adjust your spends if you find that you’re falling behind. To monitor how well you are following the Rule, review your financial transactions regularly and compare them to your budget plan. It could also be helpful to set up an automated system that sends notifications when you spend above a certain amount.

You can also use budget apps to help you track your progress. These apps can help you stay organized and provide you with helpful insights into your spending habits. Additionally, you can use budgeting apps to set up reminders for yourself to help you stay on track with your budget. By tracking your progress, you can make sure that you are staying within your budget and making the most of your money.

What to Do When You Can’t Follow 50/30/20 Rule

50/30/20 Rule is designed to be a guideline, not a strict set of rules. It’s ok if you can’t follow it exactly—simply adjust the percentages according to your financial situation. For example, if you have large debt payments, consider allocating more than 20% toward debt repayment to get out of debt as quickly as possible.

If you have a low income, you may need to adjust the percentages to fit your budget. Consider allocating more than 50% of your income to essential expenses such as rent, food, and utilities. You may also need to reduce your savings and debt repayment goals to a more manageable level.

If you have a high income, you may be able to allocate more than 20% of your income to savings and debt repayment. Consider setting up an emergency fund and increasing your retirement contributions to take advantage of the extra money.

Making the Most Out of Your Money with the 50-30-20 Rule

When armed with the knowledge of the 50-30-20 Rule, a sensible approach to budgeting and careful tracking of spending habits, individuals can make smart financial decisions that aid in their ability to save and reach financial stability. This can lead to better decision-making in both the short-term and long-term areas of personal finance.

The 50-30-20 Rule is a simple way to budget your money. It suggests that you should allocate 50% of your income to essential expenses, such as rent, food, and utilities. The next 30% should be allocated to discretionary expenses, such as entertainment, travel, and hobbies. The remaining 20% should be saved for long-term goals, such as retirement or a down payment on a house. By following this rule, you can ensure that you are making the most out of your money and setting yourself up for financial success.

Common Mistakes When Following the 50/30/20 Rule

There are several common mistakes when using the 50-30-20 Rule. Most importantly, it’s important not to get too caught up in being exact with percentages—it’s more important to have a general understanding of what the Rule suggests so that you are able to make informed decisions with your money. It’s also important to realize that while following this Rule can help you achieve long-term financial stability, it may require short-term sacrifices in certain areas.

Another mistake to avoid is to not account for unforeseen circumstances. While the 50-30-20 Rule is a great way to budget your money, it’s important to remember that life is unpredictable and you may need to adjust your budget accordingly. It’s also important to remember that the Rule is not a one-size-fits-all solution and that you should adjust it to fit your individual needs and goals.

Alternatives to the 50/30/20 Rule

The 50-30-20 Rule isn’t for everyone, so there are alternative budgeting approaches. The two popular options include the Envelope System and Zero-based Budgeting.

The Envelope System

With this system, you allocate a certain amount of money each month for each expense category and use physical envelopes (or digital accounts) to manage them,

The Envelope System is a great way to stay on top of your budget and ensure that you don’t overspend in any one category. It also helps to keep your spending organized and visible, so you can easily track your progress.

Zero Based Budgeting

Zero-based budgets start with zero each month and assign every rupee to an expense or saving goal.

Zero-based budgeting is a great way to ensure that you are making the most of your money and that you are not overspending. It also helps to keep your budget balanced and allows you to prioritize your spending and saving goals.

Wrapping Up: Improve Your Financial Habits with the 50-30-20 Rule

Budgeting can be intimidating at first, but following the 50-30-20 rule doesn’t have to be daunting. By understanding how this rule works and setting achievable goals, you can create a budget that works for you. Ultimately, following this rule will help you improve your financial habits and reach financial stability.

The 50-30-20 rule is a great starting point for budgeting, but it’s important to remember that everyone’s financial situation is different. You may need to adjust the percentages to fit your individual needs. Additionally, it’s important to track your spending and review your budget regularly to ensure that you’re staying on track. With a little bit of effort, you can create a budget that works for you and helps you reach your financial goals.